How Offshore Trusts Can Secure Multinational Investments

How Offshore Trusts Can Secure Multinational Investments

Blog Article

Why You Must Think About an Offshore Trust Fund for Shielding Your Possessions and Future Generations

If you're seeking to safeguard your wealth and assure it lasts for future generations, considering an overseas depend on may be a clever step. These depends on use unique advantages, such as improved property security and tax efficiency, while likewise maintaining your personal privacy. As you explore the possibility of offshore counts on, you'll discover just how they can be customized to fit your particular demands and objectives. However exactly what makes them so appealing?

Recognizing Offshore Counts On: What They Are and Exactly How They Work

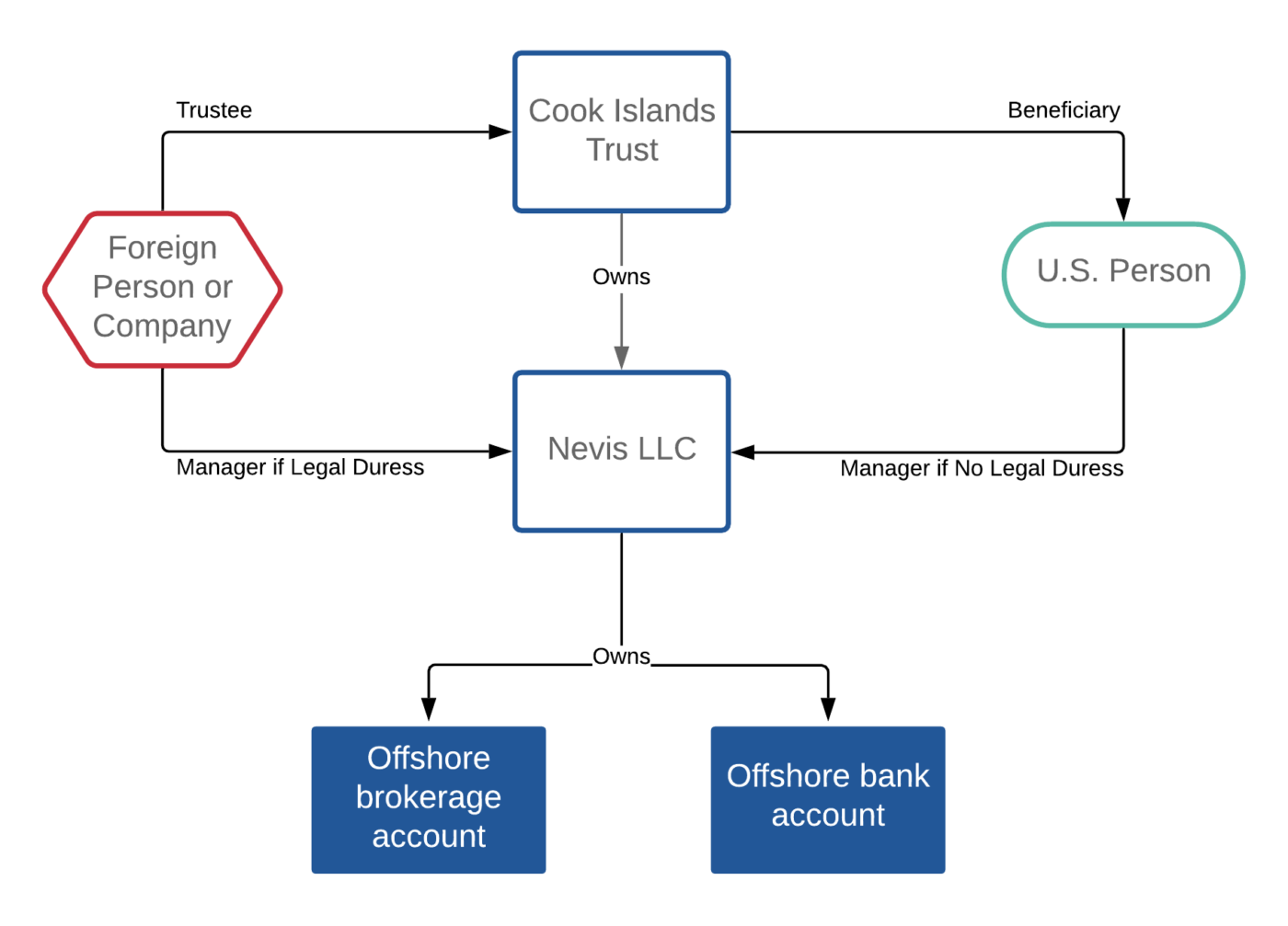

When you think of securing your possessions, offshore trust funds could enter your mind as a practical choice. An overseas trust fund is a lawful arrangement where you transfer your assets to a trustee located in one more country. This trustee takes care of those assets in support of the beneficiaries you designate. You preserve some control over the depend on, yet the lawful possession changes to the trustee, supplying protection from prospective financial institutions and lawful cases.

The trick elements of an offshore trust fund consist of the settlor (you), the trustee, and the recipients. Comprehending how overseas depends on feature is crucial before you determine whether they're the ideal choice for your property defense method.

Benefits of Developing an Offshore Trust Fund

Why should you take into consideration establishing an offshore trust fund? Additionally, offshore trust funds offer flexibility relating to property monitoring (Offshore Trusts).

One more key advantage is personal privacy. Offshore trust funds can provide a higher level of discretion, shielding your financial affairs from public examination. This can be crucial for those intending to keep their riches discreet. Developing an overseas trust fund can advertise generational wide range preservation. It allows you to establish terms for how your assets are distributed, guaranteeing they benefit your future generations. Inevitably, an offshore trust can work as a strategic tool for safeguarding your economic heritage.

Protecting Your Properties From Legal Claims and Creditors

Establishing an overseas trust fund not just uses tax obligation advantages and personal privacy however also works as a powerful shield versus legal claims and financial institutions. When you put your properties in an offshore trust, they're no more thought about part of your individual estate, making it a lot harder for creditors to access them. This splitting up can secure your wealth from legal actions and insurance claims arising from service conflicts or individual obligations.

With the appropriate territory, your properties can gain from stringent privacy laws that deter financial institutions from pursuing your wide range. Additionally, several offshore trust funds are developed to be testing to penetrate, typically calling for court activity in the trust fund's jurisdiction, which can act as a deterrent.

Tax Obligation Efficiency: Decreasing Tax Liabilities With Offshore Trusts

Furthermore, since depends on are frequently exhausted in different ways than people, you can gain from lower tax prices. It's crucial, nevertheless, to structure your count on effectively to guarantee compliance with both domestic and international tax regulations. Dealing with a professional tax expert can help you navigate these complexities.

Ensuring Privacy and Privacy for Your Wealth

When it pertains to securing your riches, ensuring privacy and confidentiality is crucial in today's significantly transparent monetary landscape. An overseas trust can offer a layer of protection that's hard to accomplish through domestic choices. By placing your properties in an overseas territory, you secure your economic info from public analysis and minimize the threat of undesirable interest.

These trust funds usually come with rigorous privacy legislations that protect against unauthorized accessibility to your economic information. This suggests you can secure your wide range while maintaining your satisfaction. You'll additionally restrict the possibility of lawful disputes, as the information of your trust fund remain personal.

Moreover, having an overseas depend on implies your assets are less vulnerable to individual obligation insurance claims or unforeseen financial dilemmas. It's a positive step you can require to ensure your economic heritage continues to be intact and personal for future generations. Count on an overseas framework to secure your wealth effectively.

Control Over Possession Circulation and Monitoring

Control over property circulation and monitoring is one of the essential advantages of establishing an offshore trust fund. By developing this trust fund, you can dictate just how and when your properties are distributed to beneficiaries. You're not just turning over your wide range; you're setting terms that mirror your browse around these guys vision for your legacy.

You can establish certain conditions for circulations, ensuring that recipients fulfill certain requirements before receiving their share. This control aids protect against mismanagement and warranties your properties are utilized in ways you consider ideal.

In addition, appointing a trustee allows you to delegate monitoring duties while retaining oversight. You can choose someone that lines up with your worths and understands your goals, assuring your assets are handled intelligently.

With an offshore trust, you're not just securing your wealth however likewise forming the future of your beneficiaries, supplying them with the assistance they need while preserving your desired level of control.

Selecting the Right Jurisdiction for Your Offshore Count On

Search for nations with you could try these out solid lawful structures that support trust fund legislations, guaranteeing that your assets remain secure from prospective future cases. In addition, availability to local banks and skilled trustees can make a huge difference in handling your depend on properly.

It's vital to analyze the prices included also; some territories may have greater configuration or maintenance charges. Inevitably, picking the appropriate jurisdiction indicates straightening your monetary goals and family needs with the specific benefits used by that location - Offshore Trusts. Take your time to research study and seek advice from professionals to make the most informed choice

Regularly Asked Concerns

What Are the Expenses Connected With Establishing an Offshore Trust?

Establishing an overseas trust fund includes different expenses, consisting of lawful fees, configuration costs, and ongoing maintenance costs. You'll intend to allocate these factors to assure your depend on runs effectively and successfully.

Exactly How Can I Locate a Reputable Offshore Depend On Supplier?

To discover a reliable overseas trust service provider, study online reviews, ask for references, and validate qualifications. See to it they're experienced and clear regarding charges, solutions, and laws. Depend on your impulses throughout the selection procedure.

Can I Manage My Offshore Trust Remotely?

Yes, you can handle your offshore count on from another location. Lots of companies use online accessibility, permitting you to keep an eye on financial investments, communicate with trustees, and access documents from anywhere. Just ensure you have protected web accessibility to protect your info.

What Takes place if I Relocate To a Various Country?

If you move to a various nation, your offshore trust's guidelines might alter. You'll require to seek advice from with your trustee and possibly readjust your count on's terms to abide with neighborhood laws my response and tax implications.

Are Offshore Trusts Legal for People of All Countries?

Yes, overseas counts on are lawful for citizens of numerous countries, yet guidelines vary. It's necessary to investigate your country's legislations and consult a legal expert to ensure conformity and recognize prospective tax ramifications prior to continuing.

Report this page